The United States has filed a complaint seeking to bar Louisiana tax return preparers from owning or operating a tax return preparation business and preparing tax returns for others, the Justice Department announced today.

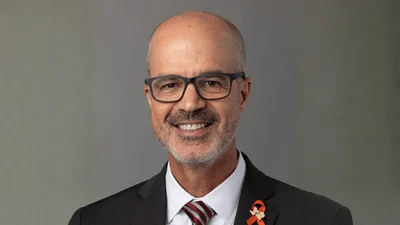

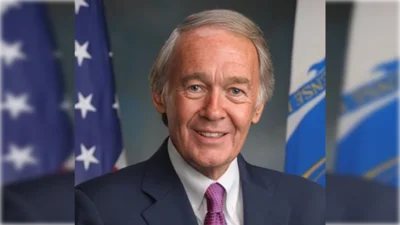

The civil complaint against Leroi Gorman Jackson and Mario Alexander, both individually and doing business as The Taxman Financial Services LLC, was filed in the U.S. District Court for the Eastern District of Louisiana. The complaint alleges that Jackson formed The Taxman Financial Services in 2013 and manages its six offices across Louisiana and Texas, and that Alexander started working there as a tax preparer in 2016. According to the complaint, in October 2019, the Civil District Court for the Parish of Orleans permanently enjoined Jackson from working as a Louisiana tax preparer. The complaint alleges that Jackson and Alexander prepared tax returns claiming fabricated business expenses, as well as claiming various false tax deductions and credits, including charitable contributions and education credits. It also alleges that defendants fabricated business income and/or expenses in order to increase claims for earned income tax credits (because of the way the EITC is calculated, reporting more income can, up to a point, result in a larger refundable credit; similarly, claiming losses to offset higher income, thereby decreasing total reported income, can also generate a larger refundable credit). According to the complaint, Jackson and Alexander significantly underreported their customers’ tax liabilities, obtained fraudulent tax refunds, and charged exorbitant fees for their services, often without their customers’ knowledge.

The government further alleges in the complaint that defendants have filed over 12,400 tax returns since the 2017 filing season, and that they have filed tax returns using other tax preparers’ personal identifying information. The complaint alleges that Alexander, at least, has done so in order to avoid an IRS investigation as to whether he has complied with due diligence requirements that obligate a tax return preparer to make reasonable inquiries to ensure that a customer is legitimately entitled to various tax credits, including the earned income tax credit. According to the complaint, Alexander is subject to and has not paid penalties incurred for past violations of these due diligence requirements.

Return preparer fraud is one of the IRS’ Dirty Dozen Tax Scams and taxpayers seeking a return preparer should remain vigilant (more information can also be found here ). The IRS has information on its website for choosing a tax preparer and has launched a free directory of federal tax preparers. In addition, IRS Free File , a public-private partnership, offers free online tax preparation and filing options on IRS partner websites for individuals whose adjusted gross income is under $72,000. For individuals whose income is over that threshold, IRS Free File offers electronical federal tax forms that can be filled out and filed online for free.

In the past decade, the Department of Justice’s Tax Division has obtained injunctions against hundreds of unscrupulous tax preparers. Information about these cases is available on the Justice Department website. An alphabetical listing of persons enjoined from preparing returns and promoting tax schemes can be found on this page. If you believe that one of the enjoined persons or businesses may be violating an injunction, please contact the Tax Division with details.

Source: US Department of Justice