A Utah professional tax preparer was sentenced yesterday to 37 months in prison for tax evasion, conspiring to defraud the United States and obstructing the IRS’s efforts to collect his tax debt, which exceeded $1.1 million.

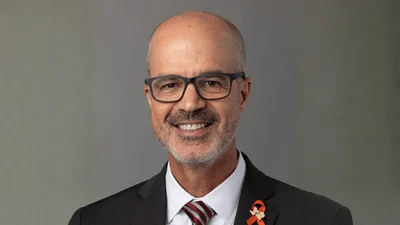

According to court documents and statements made in court, Sergio Sosa, of Orem, owned and operated Sergio Central Latino, a tax preparation business. From approximately 2004 to 2020, Sosa conspired to defraud the United States by concealing his assets and income from the IRS. From 2003 through 2017, Sosa also did not timely file his own tax returns or pay the taxes he owed for these years. After the IRS audited Sosa and began efforts to collect his tax debt – which at the time amounted to more than $750,000 – he obstructed those efforts by using nominees to open business bank accounts, renaming his business and placing it in his children’s names, and making false statements to the IRS. Sosa also directed one of his children to make mortgage payments on his personal residence using funds he provided.

In addition to the term of imprisonment, U.S. District Judge David Sam ordered Sosa to serve 36 months of supervised release and to pay $1,104,737 in restitution to the United States.

Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney Trina A. Higgins for the District of Utah made the announcement.

IRS-Criminal Investigation investigated the case.

Trial Attorney Ahmed Almudallal of the Tax Division and Assistant U.S. Attorney Ruth Hackford-Peer for the District of Utah prosecuted the case.

Original source can be found here