The Federal Trade Commission (FTC) has initiated a lawsuit that is prompting changes for consumers using H&R Block's online tax filing services. The proposed settlement aims to prevent H&R Block from imposing unfair requirements on customers who wish to downgrade to cheaper products, from deleting users' previously entered data, and from making misleading claims about "free" tax filing.

H&R Block has agreed to implement several changes for the 2025 tax season as part of the settlement. Additionally, the company will pay $7 million to the FTC to compensate consumers affected by its practices.

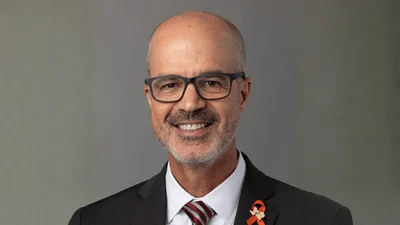

"American taxpayers who seek tax-filing help should be able to choose the services they need—and know the truth about how much they’ll pay," stated Samuel Levine, Director of the FTC’s Bureau of Consumer Protection. "The FTC’s action today will help lower the stress and expense of tax season for millions of taxpayers."

In February 2024, the FTC filed an administrative lawsuit against H&R Block, alleging that the company falsely advertised its online tax filing products as "free" when most consumers could not file without incurring costs.

The complaint also highlighted that H&R Block did not clearly explain which products covered specific forms or situations. This lack of clarity led many consumers to use more expensive products than necessary. When attempting to switch to a less costly option, customers faced obstacles such as needing to contact customer service and having their data deleted upon downgrading. However, upgrading was not met with similar challenges.

Under the proposed settlement, H&R Block must make it easier for consumers to downgrade without contacting customer service and stop deleting previously entered data by February 15, 2025. By 2026, if a consumer returns to a downgraded product after upgrading, they should resume their filing at the same point where they left off.

Furthermore, H&R Block must provide clear disclosures in its "free" advertising regarding eligibility criteria or indicate that most taxpayers do not qualify for free services.

The Commission voted unanimously (5-0) in favor of accepting the consent agreement. Commissioner Andrew Ferguson issued a statement while Commissioner Melissa Holyoak concurred with accepting it for public comment but clarified this does not imply her final approval. The agreement will soon be published in the Federal Register and open for public comment for 30 days before potentially becoming final.

Once finalized, violations of this consent order may incur civil penalties up to $51,744 per violation.

The staff attorneys involved are Claire Wack, Simon Barth, Christopher E. Brown, and Josh Doan from the FTC’s Bureau of Consumer Protection.

The Federal Trade Commission aims to promote competition and protect consumers through education and enforcement actions against deceptive practices. For more information on consumer topics or reporting frauds visit consumer.ftc.gov or ReportFraud.ftc.gov.