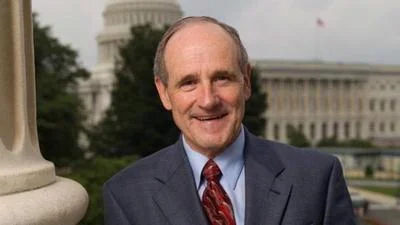

(WASHINGTON, D.C.) U.S. Senator Max Baucus, ranking member of the Senate Finance

Committee, released the following statement regarding today’s Internal Revenue Service (IRS)

announcement on the results of the Executive Stock Option and Son of Boss tax shelter

settlement initiatives. The agency estimates that over $4 billion in tax, penalties and interest

from over 1,300 high income taxpayers will be collected as a result of these efforts.

“I support the IRS’s use of settlement initiatives to stop abusive tax shelter activity. They are an

innovative and efficient way to encourage taxpayers who got involved in these deals to come

forward and straighten out their taxes, while at the same time sending a strong message that

those who continue to hide will be subjected to the most stringent terms and penalties. This is a

smart way to do business.

“Tax shelters must not be tolerated. I urge the IRS to commit the necessary resources to

eliminate them once and for all. These settlement initiatives are a step in the right direction."

The full text of “Robust Response for Executive Stock Option Initiative; Son of Boss Settlement

Heading for $4 Billion" can be located at IR-2005-72.

(WASHINGTON, D.C.) U.S. Senator Max Baucus, ranking member of the Senate FinanceCommittee, released the following statement regarding today’s Internal Revenue Service (IRS)announcement on the results of the Executive Stock Option and Son of Boss tax sheltersettlement initiatives. The agency estimates that over $4 billion in tax, penalties and interestfrom over 1,300 high income taxpayers will be collected as a result of these efforts.

“I support the IRS’s use of settlement initiatives to stop abusive tax shelter activity. They are aninnovative and efficient way to encourage taxpayers who got involved in these deals to comeforward and straighten out their taxes, while at the same time sending a strong message thatthose who continue to hide will be subjected to the most stringent terms and penalties. This is asmart way to do business.

“Tax shelters must not be tolerated. I urge the IRS to commit the necessary resources toeliminate them once and for all. These settlement initiatives are a step in the right direction."The full text of “Robust Response for Executive Stock Option Initiative; Son of Boss SettlementHeading for $4 Billion" can be located at IR-2005-72.