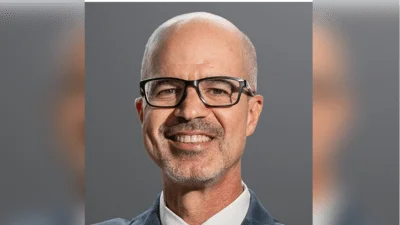

Hearing Statement of Senator Max Baucus (D-Mont.)

Regarding Estate Tax Reform: Reviewing Ideas to Simplify Planning

A Chinese proverb says: “Planning lies with men. Success lies with Heaven."

That’s certainly true with the estate tax. No matter how hard people plan, what estate tax their family will pay can be largely a matter of chance. It can be pretty much up to Heaven.

Current estate tax law is complicated. It lacks certainty for American families. The law changes, and changes, and changes.

We seriously need reform.

This is the third hearing that the Finance Committee has held to tackle the issues.

In November, witnesses testified about the difficulty that the changing law causes estate planning.

Witnesses testified that depending on the year, you could have a large estate tax liability,

or you could have no estate tax liability. That’s because the law changes every year from

2008 to 2011.

Last month, we focused on alternatives to our current estate tax. Witnesses identified proposals to simplify our estate tax system.

This hearing will focus on some more possible reform proposals.

We’ll discuss the liquidity problems of small and family-owned businesses.

Current law allows qualifying small businesses to defer paying estate tax and to pay in installments. But the law is overly complex and subjective.

We’ll discuss the exemption for couples under current law. When a person dies, the exemption is either used or it is completely lost.

So today, we’re discussing portability. Portability would allow a spouse to transfer any remaining exemption to the surviving spouse. That would give the couple the full exemption.

We’ll discuss reunifying the gift and estate taxes.

Prior to the 2001 tax changes, the gift and estate taxes were unified. They had a single graduated rate schedule.

And the estate and gift taxes were also combined into a single unified credit. That meant that taxpayers could use their gift tax credit while they were alive. And if taxpayers did not use their entire unified credit amount while they were alive, their estates could use the remainder of the credit to eliminate or offset estate tax liability.

Now, the amount that transferors can transfer tax-free while alive is substantially less than the amount that they can transfer tax-free at death.

And we’ll discuss charitable giving under transfer taxes. The estate tax law allows for an unlimited exclusion of charitable bequests. We’ll discuss how various reform proposals would affect charitable giving.

I hope that these hearings will spark a good policy debate. And I hope that the debate will lead to a bipartisan estate tax compromise.

Because whether you can leave something to your kids should not be entirely up to Heaven. The operation of our estate tax law should not be entirely a matter of chance.

And Congress needs to do a little better planning.

Source: Ranking Member’s News