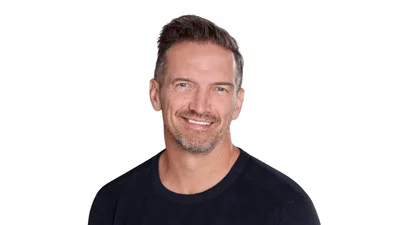

Washington, DC - As millions of Americans filed their income tax returns today, Senate Finance Committee Chairman Max Baucus (D-Mont.) kicked off a series of hearings on tax reform with a look at America’s income tax code, and announced plans for future hearings and roundtable sessions to prepare for a comprehensive overhaul of the tax code in 2009. The Finance Committee has jurisdiction over U.S. tax policy, and Baucus said that this year’s look at our tax system and reform options should produce a set of principles to guide the work of the Committee - and a new presidential administration - on tax reform next year.

“The Finance Committee needs to be informed and ready to go in January 2009, and that means we have to work hard now. We have to first understand pretty comprehensively how the system works today. We have to talk about the natural tensions in tax reform, and what actually happens to working families, to American businesses, and to our country’s global competitiveness depending on how we change the code," Baucus said. “Even in a year where much won’t get done legislatively, we can build a framework of knowledge on which to review options and proposals when it’s time for tax reform."

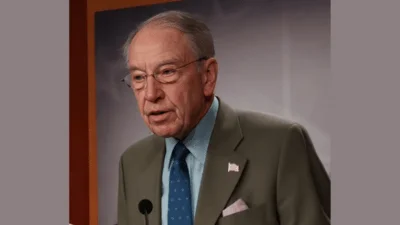

Baucus said three additional hearings are already on the Finance calendar, to be developed in consultation with Ranking Member Chuck Grassley (R-Iowa) and with members on both sides of the panel. Initial topics will include:

* May 13 - Taxing Individuals: This hearing will review the concept of implementing social policies through the tax code, will identify those goals that the tax code addresses most effectively, and will ask whether these goals should be part of a reformed system.

* June 5 - Taxing Businesses: This hearing will explore the way we currently tax the income of domestic non-corporate businesses and will seek to identify the economic effects of the current multi-tiered pass-through regime.

* July (date TBA) - Taxing American Multi-Nationals: This hearing will examine how to ensure equity and competitiveness in taxing of multi-national companies.

Baucus said that issues uncovered at the tax reform hearings will be further explored in expert roundtables. He intends to work with Committee members to plan the roundtables and additional hearings this year.

Source: Ranking Member’s News