Washington, DC - Senate Finance Committee Chairman Max Baucus (D-Mont.) and Ranking Member Chuck Grassley (R-Iowa) today won Senate passage, by a vote of 63-5, of a package of tax measures in the housing bill, H.R. 3221. A procedural vote yesterday in support of this bill passed 84-12. The bill was crafted in cooperation with the Senate Banking Committee and includes important tax credits and incentives for property owners and first-time homebuyers. The Baucus-Grassley tax measures, which total approximately $14 billion over 10 years, would create an additional standard deduction for property taxes for homeowners who do not itemize their federal taxes, provide an $8,000 refundable, repayable tax credit that will help first time home buyers purchase homes and reduce the existing stock of unoccupied housing, and increase funding for mortgage revenue bonds, which will help homeowners and buyers obtain affordable loans. Also included is a provision to increase the amount of Federal low-income housing tax credits (LIHTC).

“Times are tough right now for families and homeowners and today we rolled up our sleeves, put our differences aside and passed practical, fiscally sound tax solutions to help millions of working Americans," Baucus said. “Whether it’s a standard deduction for property taxes, refinancing subprime loans, or help to relieve the glut of vacant homes on the market, these tax provisions will help keep property values up and keep folks in their homes. The standard property tax deduction, in particular, will bring tax relief to tens of millions of American homeowners who currently don’t itemize on their Federal taxes, and that’s a win for working families."

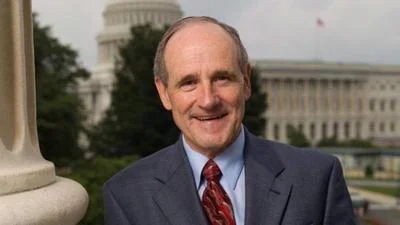

“These tax initiatives are designed to complement the provisions in the housing bill to help Americans who are losing their homes in foreclosures," Grassley said. “The tax provisions work to bring stability to the housing marketplace for every homeowner by reducing the number of homes that are for sale and unoccupied. This package would help increase the availability of affordable rental housing for lower-income Americans and encourage first time home purchases. The legislation also would provide immediately available tax-related assistance for taxpayers who’ve lost homes in natural disasters, including the floods and tornadoes in Iowa during the last month."

Provisions to offset the cost of this important tax relief include a condition that banks provide information returns reporting annual credit card sales to the IRS and to merchants, a provision that requires homeowners to pay taxes on gains made from the sale of a second home to reflect the portion of time the home was used as a vacation or rental property, and enhancements to Internal Revenue Service (IRS) penalties on companies and individuals that fail to correctly report or neglect to timely file certain tax documents required by the IRS.

A complete summary of the tax provisions can be found in the printer-friendly version of this release.

Source: Ranking Member’s News