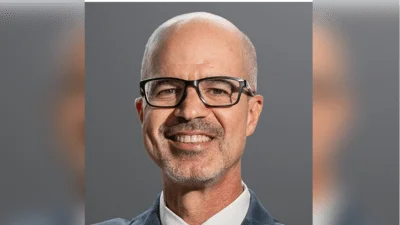

Sen. Chuck Grassley, ranking member of the Committee on Finance, today made the following comment on a new report from the Treasury Inspector General for Tax Administration on the IRS’ improved whistleblower program. The report is available at http://www.treas.gov/tigta/auditreports/2009reports/200930114fr.pdf. Grassley worked to improve the whistleblower program at the IRS to fight tax fraud. Grassley is the Senate author of the 1986 whistleblower amendments to the federal False Claims Act.

“During the first two years after enactment of the improvements I brought forward, the IRS has received nearly 2,000 claims from whistleblowers alleging tax violations of at least $2 million per claim. In 2008, the filed claims represented more than $65 billion in underreported income. While the program promises to be a success, it is troubling that several hundred claims appear to be sitting on an analyst’s desk instead of being worked on by examination or criminal investigation personnel. This combined with the IRS’ delay in notifying whistleblowers when their claims are rejected could frustrate whistleblowers and discourage them from bringing forward these important cases. As I’ve said before, I hope the IRS will work faster to process the whistleblower submissions, try not to accumulate a backlog, and stop as many big-dollar fraud operations as possible. Good-faith whistleblowers often have very valuable things to say. The IRS should see them as a valuable resource in fighting the tax gap and put their knowledge to good use."