U.S. Reps. Maxine Waters (D-Calif.) and Patrick McHenry (R-N.C.) announced earlier this month that they will lead a bipartisan investigation into the collapse of a multi-billion-dollar cryptocurrency firm.

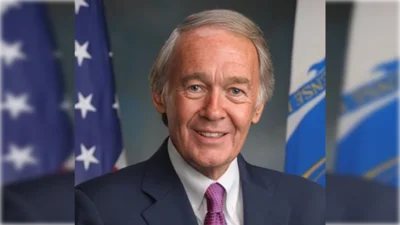

Waters, chairwoman of the House Financial Services Committee (HFSC), and McHenry, ranking member of the HFSC, announced on Nov. 16 they would conduct a hearing into the crash of FTX "and the broader consequences for the digital asset ecosystem." The cryptocurrency exchange filed for bankruptcy Nov. 11, losing billions of dollars of investors' money.

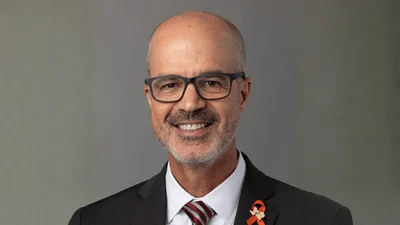

McHenry, in announcing the House Financial Services Committee (HFSC) investigation "on the FTX debacle," said "Oversight is one of Congress’ most critical functions and we must get to the bottom of this for FTX’s customers and the American people."

The Nov. 11 bankruptcy filing by cryptocurrency platform FTX, once valued at $32 billion according to news reports, wiped out billions of dollars of value from the company, its founder Sam Bankman-Fried, investors and the broader crypto markets. Anxiety over alleged "improper use of client funds" triggered a run on FTX deposits, which caused a liquidity shortfall of approximately $8 billion, according to Thomas Wade, director of financial services policy at the American Action Forum (AAF).

Wade called the FTX collapse "the most high-profile and significant casualty of crypto’s wavering fortunes both on the market and in Washington."

Wade writes in the article that when FTX "and a number of other Bankman-Fried vehicles" including Alameda Research filed for bankruptcy, the entrepreneur resigned as CEO and the companies' value fell up to 90%, "shortly after the bankruptcy filings, more than $600 million in digital assets were reportedly stolen from FTX in a hack."

"At least" $1 billion in client funds went missing from FTX, Reuters reported Nov. 13, with some sources putting the figure at $2 billion. The news agency reports Bankman-Fried covertly moved $10 billion in customer funds from FTX to Alameda Research, and a "large portion of that has since disappeared."

Bankman-Fried, 30, has denied allegations that he built a "backdoor" into FTX which allowed him to transfer the funds without alerting any other internal or external officials, Reuters reports.

"Lawmakers and regulators are left to deal with the fallout," Wade wrote in the AAF article, "after the collapse of a firm and individual that had been a key presence in Washington policy debates about crypto and broader questions as to the regulation and supervision of this growing market."

In addition to the HFSC hearings, the U.S. Securities and Exchange Commission, the Department of Justice, and the Commodity Futures Trading Commission have also announced intentions to investigate the FTX collapse, Reuters reports.

"It’s essential that we hold bad actors accountable so responsible players can harness technology to build a more inclusive financial system," Rep. McHenry said in the announcement. "I appreciate Chairwoman Waters’ working with Republicans to deliver accountability through a bipartisan process.”

Rep. Waters said the FTX collapse caused "tremendous harm" to more than one million users, "many of whom were everyday people who invested their hard-earned savings into the FTX cryptocurrency exchange, only to watch it all disappear within a matter of seconds."

“As Chairwoman of the Financial Services Committee," she said, "I have led the effort in examining and investigating the digital assets marketplace, and know that we need legislative action to ensure that digital assets entities cannot operate in the shadows outside of robust federal oversight and clear rules of the road. I look forward to holding this important hearing, and uncovering all that Congress must do to ensure this never happens again."

Bankman-Fried, along with FTX co-founder Gary Wang and director of engineering Nishad Singh, are in the Bahamas and are trying to find a way to flee to Dubai, according to Cointelegraph, which reports they are “under supervision” by the local authorities.

FTX announced in a Nov. 11 press release posted on Twitter that Bankman-Fried will be replaced as CEO by John J. Ray III.