JPMorgan Chase Bank, N.A., has entered into an agreement to assume all deposits and substantially all of the assets of First Republic Bank.

San Francisco-based First Republic Bank has been closed by the California Department of Financial Protection and Innovation, and the Federal Deposit Insurance Corporation (FDIC) has been appointed as receiver, a recent press release from the FDIC said. In order to protect depositors, the FDIC has entered into a purchase-and-assumption agreement with JPMorgan Chase Bank to assume all of the deposits and substantially all of the assets of First Republic Bank.

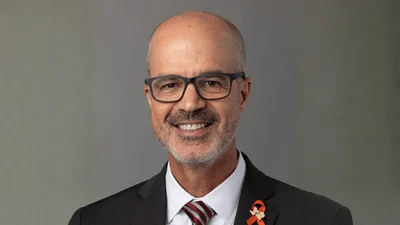

“Americans should remain confident in the safety of their deposits at U.S. banks,” U.S. Rep. Patrick T. McHenry (R-NC), House Financial Services Committee chairman, said in a recent press release from the committee. “The FDIC used its available tools to resolve First Republic Bank. I appreciate the quick work of regulators to facilitate a sale of the bank’s assets, while minimizing risk to taxpayers. The question remains, why didn't the FDIC do the same thing in March when SVB was placed into receivership. It’s critical that the Biden Administration and its regulators not politicize these events. As Chairman of the House Financial Services Committee, I will ensure Members of Congress receive appropriate briefings and information from our federal banking regulators. The Committee will continue to use its authority to provide the transparency the American people deserve regarding recent bank failures.”

As a part of the agreement, First Republic Bank's 84 offices in eight states will reopen as branches of JPMorgan Chase Bank. Deposits will continue to be insured by the FDIC, and customers will have full access to all of their deposits. JPMorgan Chase Bank will also assume all Qualified Financial Contracts.

The FDIC has estimated that the total cost to the Deposit Insurance Fund will be approximately $13 billion.