New Data Shows Streamlined Procedure Is Helping Increasing Numbers of Eligible Borrowers

WASHINGTON – The Justice Department, in close coordination with the Department of Education, announced today the continued and growing success of a process instituted in November 2022 for handling cases in which individuals seek to discharge their federal student loans in bankruptcy. Data tracking the effectiveness of the process over the last year and a half demonstrate that it is achieving its goal of providing a more transparent, equitable, and streamlined mechanism for borrowers to request a discharge of their student loans in consumer bankruptcy cases. The process has translated into increasing numbers of eligible federal student loan borrowers seeking and obtaining debt relief under the Bankruptcy Code.

The departments finalized new guidance in November 2022 that outlined a fairer, more accessible process to ensure consistent treatment of the discharge of federal student loans, reduce the burden on borrowers pursuing such proceedings, and facilitate identifying cases where discharge is appropriate. At the time, both Departments committed to an ongoing assessment of the guidance’s effectiveness. As part of that commitment, the Justice Department surveyed all 94 U.S. Attorneys’ Offices after the first year of implementation and recently repeated its survey to obtain updated information about use of the guidance.

The information collected from these surveys indicates that the new process continues to be successful, with an increasing number of borrowers seeking and receiving discharges of their federal student loan debts. Since the process was announced a year and a half ago, data collected by the departments reveals:

- Case filings have steadily increased as consumers have learned about the new process. A total of 588 new cases were filed from October 2023 to March alone, which is a 36% increase from the prior six-month period. A total of 1,220 cases were filed from November 2022 through March.

- In cases decided by courts from November 2022 through March, 98% have provided debt relief through full or partial discharge.

- Borrowers continue to embrace the new process set forth in the guidance in large numbers. In filed cases, 96% are voluntarily using this streamlined process.

- Multiple bankruptcy courts have adopted procedures recognizing this new approach.

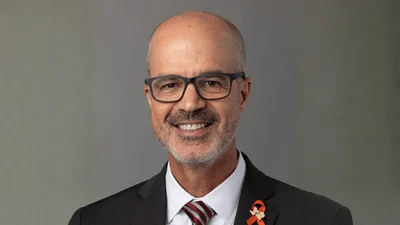

“We are now able to evaluate the success of the student loan bankruptcy discharge guidance with a robust record of empirical information,” said Acting Associate Attorney General Benjamin C. Mizer. “The results are clear: this guidance has helped make the promise of a fresh start in bankruptcy a meaningful option for individuals weighed down by student loan debt.”

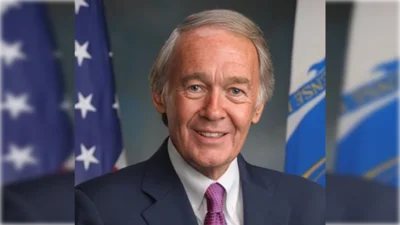

“Our clear, fair, and practical standards are helping struggling borrowers find relief that was previously out of reach,” said U.S. Under Secretary of Education James Kvaal. “This data should puncture the myth that struggling borrowers cannot discharge their student loan debt through bankruptcy. We will continue to work with our partners at the Department of Justice to make it simpler and easier for borrowers to get much-needed relief in the way it was intended.”

In addition to internal data surveys, other measures have been taken by both departments to support and evaluate this new guidance. The Justice Department has consulted closely with consumer law groups including input from organizations like National Association Consumer Bankruptcy Attorneys (NACBA). Training events supported by regional bar associations and courts have also been conducted for attorneys as well as members of public.

The Departments will continue monitoring this guidance's impact ensuring its appropriate implementation meeting designed goals.