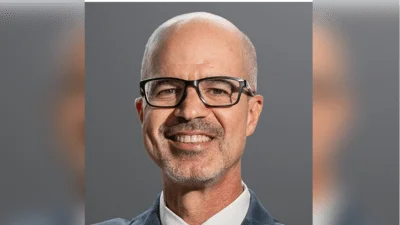

Deputy Secretary of the Treasury Wally Adeyemo recently spoke on the topic of Voluntary Carbon Markets (VCMs) at an event hosted by the Global Carbon Market Utility, the Integrity Council for the Voluntary Carbon Market (IC-VCM), and the Voluntary Carbon Markets Integrity Initiative. In his remarks, Adeyemo highlighted the Biden-Harris Administration's efforts in addressing climate change over the past three and a half years.

Adeyemo stated that the administration has led several initiatives, including implementing tax provisions from the Inflation Reduction Act to drive private sector investment in clean energy. He also mentioned that Treasury has published Principles for Net-Zero Financing and Investment to aid financial institutions in making credible net-zero commitments.

"Over the past three and a half years, the Biden-Harris Administration has pursued an aggressive climate agenda, and Treasury has been proud to play a leading role," Adeyemo said. He emphasized that tackling climate challenges requires collaboration between government, private sector, nonprofit organizations, experts, and academics.

Discussing VCMs specifically, Adeyemo noted their potential to generate economic and climate benefits by directing private capital towards impactful climate projects. However, he acknowledged current challenges hindering market growth.

In May, Treasury launched Principles for Responsible Participation in Voluntary Carbon Markets with various government partners. "We hope that these Principles can bring us closer to achieving functioning, high-integrity VCMs that live up to both the economic and climate potential we all believe in," he said.

The Principles focus on supply integrity—ensuring credits represent real emissions reductions or removals—and demand integrity—encouraging companies to reduce direct emissions before seeking carbon credits. Adeyemo cited recent steps taken to improve supply integrity, such as IC-VCM applying its Core Carbon Principle approved label to methodologies and CFTC issuing final guidance for listing voluntary carbon credits on exchanges.

"The Principles emphasize demand integrity—the idea that companies should make every effort to reduce direct emissions within their own value chains and then pursue carbon credits to complement those efforts," Adeyemo added.

Market integrity is another key aspect of these Principles. Increasing transparency around pricing and transaction data is essential for reducing risk for buyers and helping developers predict revenues more accurately. "Increasing transparency around pricing and transaction data would help buyers reduce their risk, developers better predict their revenues, and financiers develop new products," he said.

Adeyemo concluded by expressing confidence in overcoming VCM challenges through collective efforts: "VCMs hold significant potential. But we can only realize their promise if we are willing to take steps to overcome their challenges."

He thanked attendees for their participation and looked forward to continued partnership in advancing these goals.

###