Dear Mr. Secretary:

We are writing to express our continued concern regarding the inappropriate use of charitableorganizations for purposes of tax avoidance and evasion. While we are supportive of PresidentBush’s efforts to encourage charitable giving, we would like to ensure that charitable contributionstranslate into actual additional assistance to those in need.

We are particularly concerned about section 501(c)(3) charitable organizations avoiding privatefoundation rules by claiming public charity status as a Type III supporting organization (SO) undersection 509(a)(3) of the Code and section 1.509(a)-4(i) of the Treasury regulations. As a result of itsown review as well as various newspaper articles, the Finance Committee is aware of the followingabusive situations in which a taxpayer donates assets to a Type III SO and likely takes a charitablededuction for the claimed fair market value of the contribution:

1) The donated assets remain under the effective control of the donor while generating very littleincome for the charity. (The charity may be controlled by the taxpayer, such as a donor advisedfund.) In one case, an SO with over $300 million in assets distributed in one year less than $1 millionto the supported organization, a significant portion of which was to the donor advised fundcontrolled by the donor, and the SO had no other activities. This equates to a payout ofapproximately.3%. In contrast, a private foundation is generally required to payout 5% of the valueof its noncharitable use assets annually or, in this case, $15 million to charity.

2) The SO engages in offshore investment activities and, through several transactions, effectivelyreturns the money to the taxpayer. It is our understanding that this scheme also allows the taxpayerto take a deduction and avoids tax on capital gains.

3) Soon after the donation, the taxpayer receives a loan back from the Type III SO up to the amountdonated.

The common objective in these schemes involving supporting organizations is a very large charitablededuction for the donor with little charitable purpose served. The Finance Committee believes thatoften the “donation" is of assets that are difficult to value or are essentially illiquid such as stock inclosely-held corporations or antiques which if donated to a private foundation and not to an SOwould generate a deduction of the donor’s basis and not a fair market value deduction. Suchdonations also raise concerns about inflated valuations which go hand-in-hand with tax evasion andavoidance. Moreover, the supported charity that does finally receive funds from the Type III SO isoften effectively controlled by the donor so that both the SO and the supported organization becomevehicles to hold the assets in perpetuity. Another situation of concern to the Finance Committee isone where an SO is established to support a foreign organization. Although to our knowledge, therehave not been reported abuses involving SOs and foreign organizations, the Type III form of SOcould be abused to generate improper deductions for contributions to foreign organizations.

We are aware the Internal Revenue Service is currently auditing a sample of supportingorganizations. We would appreciate a status report on this initiative. The report should address thesituations and issues described above as well as inform us of any other abuses the IRS may haveuncovered. The report should also highlight organizations that may be abiding by the letter of exemptorganizations law but are violating the spirit of our laws that encourage charitable giving. We areparticularly interested in any efficiencies that can be gained through the use of non-routineenforcement techniques as well as impediments that may hinder the use of such techniques.

We are troubled that even though abuses in this area were reported by the Wall Street Journal oversix years ago there still has not been effective action taken in this area. These abuses cannot continue.Type III supporting organizations are primarily a creature of Treasury Regulations. To that end, weask: what combination of changes to the Regulations, IRS guidance and enforcement activities andlegislation is needed to curb these abuses quickly?

We strongly encourage the Department of Treasury to revisit the regulations that have created theType III supporting organizations. The Tax Reform Act of 1969 established supporting organizationsas a limited exception to the private foundation definition. As stated in the General Explanation ofthat Act, “religious organizations other than churches, the Hershey Trust (which is organized andoperated for the benefit of a specific school for orphaned boys and is controlled by or operated inconnection with that school), university presses, and similar organizations are examples oforganizations expected to qualify [as supporting organizations]." Even apart from abusive situations,the use of supporting organizations under present Treasury regulations appears to have departed fromthe original Congressional intent. It is difficult to believe that Congress intended for the strictregulation on private foundations contained in the 1969Act be eviscerated by the TreasuryDepartment regulations governing Type III supporting organization.

Thank you for your time and attention to this matter. We ask for a response within thirty days given that the Finance Committee hopes to consider the President’s proposals regarding charitable contributions in the near future.

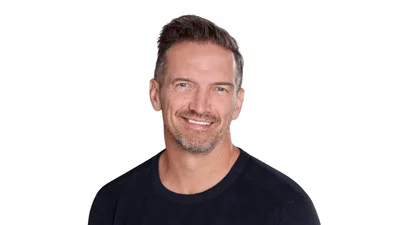

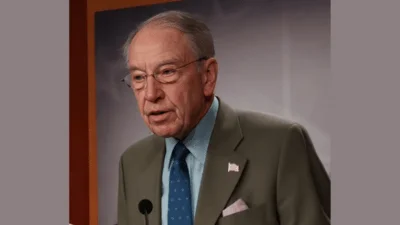

Cordially yours,

Charles E. Grassley Chairman

Max Baucus Ranking Member

Source: Ranking Member’s News