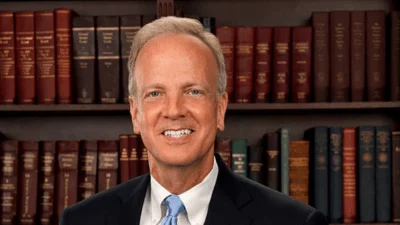

The Pension Protection Act of 2006, given final approval by the Senate last night and headed to the President for his expected signature, contains a series of provisions on tax-exempt organizations. Sen. Chuck Grassley, chairman of the Committee on Finance, developed charitable giving incentives and provisions to shut down abuse of non-profit organizations’ tax-exempt status.

He made the following comment on final passage of the package.

“The pension bill includes a good package of charitable giving incentives and loophole closers. It makes sense to tighten areas of abuse while increasing incentives for charitable giving.

Americans are very generous with their donations. They deserve to know that their money helps the needy, not the greedy. Some individuals are creative about exploiting non-profits’ tax-exempt status for personal gain, and Congress has to be just as smart about shutting down abuse. I’m grateful for the work of Sen. Santorum, who was especially helpful in developing the giving incentives, Diana Aviv of the Independent Sector and the Panel on the Nonprofit Sector, representing many of the nation’s charities in a comprehensive effort to study ways to improve the non-profit sector, and IRS Commissioner Mark Everson. They helped me put together solid proposals that received the support of my Senate colleagues and ultimately that of our House counterparts. I look forward to working with the same individuals to put together more legislative proposals to increase governance,

transparency, and accountabilty in the non-profit sector."

For more information, please see:

This message provides a link to the Joint Committee on Taxation's internet posting of:

JCX-38-06: Technical Explanation Of H.R. 4, The "Pension Protection Act Of 2006," As Passed By The House On July 28, 2006, And As Considered By The Senate On Aug. 3, 2006 http://www.house.gov/jct/x-38-06.pdf

Source: Ranking Member’s News