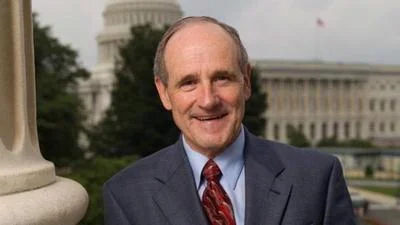

WASHINGTON - Sen. Chuck Grassley, ranking member of the Committee on Finance, has

asked the Congressional Budget Office to review the economic benefits received from the tax-

exempt status of college athletics and the practice of colleges and universities’ maintaining a large

untaxed portfolio of assets while simultaneously borrowing with tax-exempt debt.

“Educational institutions represent a big part of the non-profit sector," Grassley said. “As

part of reviewing non-profit practices, it will be helpful to get a better understanding of how colleges

and universities use their tax-exempt status in certain areas. Congress needs to know whether

educational institutions actually use their generous tax breaks to improve education, or whether the

taxpayers are subsidizing other priorities."

Grassley’s request comes as part of his broad look at the non-profit sector, aimed at making

sure non-profit institutions provide public benefit in exchange for their tax-exempt status and are

not misused for individual benefit at taxpayer expense.

The text of his letters to the Congressional Budget Office follows in the atatched Printer-Friendly verion of the press release.