Dear Secretary Leavitt:

We are writing to express concerns with technical aspects of the Feb. 22, 2008, Centers for Medicare and Medicaid Services (CMS) proposed rule to implement a provision of the Deficit Reduction Act of 2005 (DRA) that expanded states’ authority to impose cost-sharing charges and premiums on Medicaid beneficiaries. The proposed rule may violate the DRA by raising beneficiary co-payments more than Congress intended. We respectfully request that you correct the calculation of cost-sharing to avoid this outcome.

Prior to the DRA, states could impose “nominal" cost-sharing charges on Medicaid beneficiaries in certain circumstances. Current Medicaid regulations permit nominal co-payments ranging from $.50 to $3.00, depending on the amount a state pays for the service. In the DRA, Congress directed the Secretary to “increase [the ceiling on] such ‘nominal’ amounts for each year... by the annual percentage increase in the medical care component of the consumer price index for all urban consumers [CPI-U]... as rounded up in an appropriate manner."

CMS’s proposed rule updates the limits for nominal co-payments and deductibles for federal fiscal year 2007 and provides the methodology for future updates. The rule increases the cost sharing limits by 3.9 percent (the increase in the medical CPI-U from September 2004 to September 2005) and then rounds them up to the nearest 10-cent increment. For example, the maximum co-payment for a health care service that costs a state more than $50 is $3.00; to update that limit for 2007, the new rule increases it by 3.9 percent to $3.117 and then rounds that figure up to $3.20.

After setting out the new schedule of limits on nominal co-payments for 2007, the CMS rule states that in subsequent years “any copayments should not exceed these amounts as updated each October 1 by the percentage increase in the medical care component of the CPI-U... and then rounded to the next higher 10-cent increment." This is the basis for our concern because each year’s inflation adjustment would be applied to the current cost-sharing limit after it was rounded up. The effect would be to increase the cost-sharing limits over time at a rate higher than the medical CPI-U, which would appear to conflict with the DRA.

For example, the increase in nominal co-payments for 2008 will reflect a 4.2 percent increase in the medical CPI-U. If this increase were applied to the $3.20 co-payment the rule establishes for

2007, the maximum 2008 co-payment would be $3.40. But if the increase were applied to

$3.117, the 2007 amount before rounding, the maximum charge would be $3.30.

While a 10-cent difference may not appear large, the effect of applying the annual increase to the previous limit after rounding would grow steadily over time. That, in turn, would make Medicaid co-payments increasingly burdensome for beneficiaries.

This approach is unusual. In most other areas of federal law where annual inflation indexing occurs and the resulting amount is then rounded, the next year’s adjustment is applied to the unrounded base.

We are concerned that the approach that the rule takes may harm the health of some of the nation’s poorest individuals. Research shows that co-payments can cause some low-income people to go without necessary health care services. Poor people with chronic health conditions are the most vulnerable, as they use the most health care services. People who go without needed care may end up using more expensive forms of care later, such as emergency services.

In the DRA, Congress limited annual increases in nominal cost-sharing to the medical CPI-U.

The CMS proposed rule would allow for larger increases - in the example above, for instance,

co-payments would increase by 13.3 percent between 2006 and 2008, well above the 8.3 percent in the medical CPI-U, as well as the 10 percent increase that would occur if, as in most other programs, the annual increase was applied to the unrounded base. Therefore, we encourage you, in the final rule, to apply the annual percentage increases to the base amount from the prior year before rounding.

Our second concern relates to co-payments for beneficiaries in Medicaid managed care. Under current regulations, nominal co-payments range from $.50 to $3.00 based on state payments for a service. Under the DRA, maximum co-payments for people with income between 100 and 150% of federal poverty are 10% of the payment for the service and 20% of the payment for people with income over 150% of poverty. For people below poverty that are not exempt, co-payments must be nominal.

In the proposed rule, CMS adds a new maximum co-payment for services provided by managed care organizations of $5.20. In the preamble, CMS says this is necessary for states that do not have a fee-for-service program and, therefore, cannot set their co-payments based on what they pay for a particular service.

For people above poverty in states without a fee-for-service program, the rule says the maximum is $5.20 (in lieu of 10 or 20 percent of the state payment). However, the rule appears to allow a co-payment up to $5.20 regardless of whether the state has a fee-for-service program. Thus, a state could actually charge $5.20 to people with income below poverty in managed care while others with the same income not in managed care could be charged $3.20. Therefore, we encourage you, in the final rule, to clarify that the $5.20 only applies in states without a fee-forservice program and then only to co-payments for people with income over the poverty line where the DRA ties maximum cost-sharing to the cost of the service.

We appreciate your prompt attention to these matters.

Sincerely,

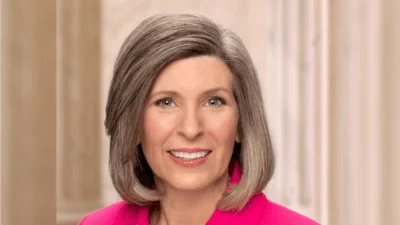

Max Baucus, Chairman Charles E. Grassley, Ranking Member

Source: Ranking Member’s News