"Coincidence or Coordinated? The Administration’s Attack on the Digital Asset Ecosystem" was a live broadcast hearing on March 9 presented by the House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion.

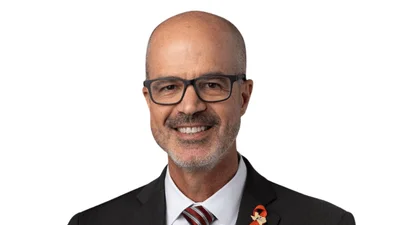

The committee is comprised of Chairman Rep. J. French Hill (R-Ark.), who led the hearing, and Vice Chairman Rep. Warren Davidson (R-Ohio). The committee also included 10 Republican and eight Democratic members.

The hearing memo said that certain Biden administration statements and proposals are threatening to push the digital asset ecosystem overseas, but committee Republicans say Congress needs to implement legislation that will clarify regulatory guidelines and enable innovation in the industry.

“The hearing will include discussion of several legislative proposals, including a bill that would safeguard Americans' privacy in digital asset transactions, a bill that would establish a working group to combat terrorism in new financial technologies and a resolution that would express support for blockchain technology and digital assets," Hill said.

The panel included Mike Belshe, a 30-year Silicon Valley veteran who co-founded and is CEO of BitGo, a digital asset financial services provider; professor Tonya Evans of Pennsylvania State University's Dickinson School of Law; Jonathan Gould, a partner at Jones Day law firm, where he specializes in bank and financial regulatory strategy; and Paul Grewal, chief legal officer at Coinbase.

Belshe opened the hearing by discussing BitGo.

“We have been building regulated products and platforms for digital assets that are regulated by numerous state and federal regulators, including New York Department, Department of Financial Services, South Dakota division of banking, the SEC and FinCEN (Financial Crimes Enforcement Network),” Belshe said. “Trust companies are different than banks in that we are not depositories. We did not lend assets, we were solely focused on the technology and compliance related to the safekeeping of our clients’ assets in segregated accounts.

"I hope BitGo and all of the regulated firms building digital asset technologies and services in America are absolutely and unequivocally committed to preventing financial crime, providing investor protections abiding by sanctions controls, building safety and soundness and our custodians and banks, and building stable market structure. We are not seeking to avoid regulatory oversight. We are not here for the purpose of building speculative assets and markets. We are here to make the financial services system better. It’s been over 10 years now since the invention of Bitcoin and the blockchain. This seemingly simple technology ... enables the instant transfer of value between anyone across the globe.”

Evans said the hearing was an opportunity to view through a nonpartisan academic lens. She accepted the invitation to help inform and calibrate the conversation about the current regulatory environment in this latest wave of financial and technological innovation in a $1 trillion emerging market.

“I also wish to explore expressed concerns about the future of America's leadership and innovation in this area, when a powerful agency uses its broad discretionary powers on a piecemeal basis without also providing commensurate clarity for regulated parties or a fair opportunity for good-faith actors to understand the rules and the consequences that apply in an entire industry,” she said. “I intend to also highlight the tremendous loss of wealth accumulation opportunities for communities of color, especially the Black community, if investment and innovation opportunities in the crypto asset ecosystem are driven offshore.”

Gould made it clear his comments were his own, and he was not speaking on behalf of any clients.

“Over the last 18 months, the federal banking agencies have issued a number of public guidance documents,” Gould said. "As Congress considers the actions of the federal banking agencies, there are three attributes of bank supervision that I would like to highlight. First, bank supervision is by design confidential, particularized and potent. Although the agency issuances are public, their application is not. The confidential nature of the supervisory relationship facilitates the flow of information between bank and regulator, but it can also frustrate accountability and oversight. Banking agencies have issued thousands of pages of public nonbinding guidance detailing their interpretations of what safety and soundness means in a variety of contexts to help banks achieve it and to facilitate consistency in the agency's supervisory expectations and approach. Finally, although agency guidance is technically nonbinding, banks rarely challenged or disregarded.”

In January, the White House published a blog post which stated "2022 was a tough year for cryptocurrencies" and highlighted a "wave of insolvencies" that shook the industry. It said that although some crypto users were negatively impacted, "thankfully, turmoil in the cryptocurrency markets has had little negative impact on the broader financial system to date."

The members of the Biden administration who authored the post said they have been working to identify and mitigate risks posed by crypto companies and found that "some cryptocurrency entities ignore applicable financial regulations and basic risk controls – practices that protect the country’s households, businesses and economy," Hill said. "The post stated that there are crypto companies that have misled consumers, engaged in fraud or failed to make appropriate disclosures. The post also condemned 'poor cybersecurity across the industry.'"

The blog post called on regulators to continue issuing guidance and working to limit the exposure of financial institutions to the crypto sector. The post asked Congress to take several actions but refrain from taking others. The members of the Biden Administration encouraged Congressional action that would "expand regulators’ powers to prevent misuses of customers’ assets – which hurt investors and distort prices – and to mitigate conflicts of interest."

The post also suggested that lawmakers could increase transparency and disclosure requirements for crypto entities and increase the penalties for breaking illicit-finance laws. The authors suggested that Congress should not pass legislation that would make it easier for traditional financial institutions to engage more deeply with crypto.

"In the past year, traditional financial institutions’ limited exposure to cryptocurrencies has prevented turmoil in cryptocurrencies from infecting the broader financial system," the blog post said. "It would be a grave mistake to enact legislation that reverses course and deepens the ties between cryptocurrencies and the broader financial system."