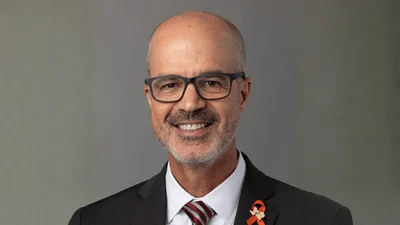

Anthony Ruggiero, a senior director at Foundation for Defense of Democracies, testified before the U.S. House Oversight and Accountability Committee about narcotics traffickers in the U.S. and Chinese money launderers.

Every two weeks, more Americans die on average from overdose deaths than they did in the Sept. 11 terrorism attacks, Ruggiero testified.

"But narco-traffickers have a problem," he said. "They they run a cash business inside the United States without an easy way to repatriate profits to Mexico. At some level, the financial measures to combat money laundering have worked and made it more difficult for the cartels simply to drive bulk

U.S. dollars over the border. That’s where Chinese money launderers come in; they see an opportunity for profit and have exploited it."

An anonymous source told Reuters that the Chinese operation is "the most sophisticated form of money laundering that’s ever existed," Ruggiero testified.

"Yet in many ways it is a new take on an old problem: Narco-traffickers need assistance from savvy financial criminals to launder drug profits through a variety of means, including trade-based money laundering," he said. "The scheme involves the largest banks in China, which are also the largest banks in the world."

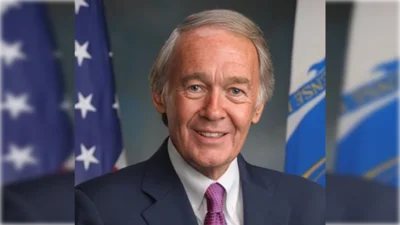

Ruggiero notes that, "In February 2023, Anne Milgram, administrator of the Drug Enforcement Administration (DEA), testified before the Senate Foreign Affairs Committee and emphasized that the use of Chinese money-laundering organizations by the cartels "simplifies the money-laundering process and streamlines the purchase of precursor chemicals utilized in manufacturing drugs."

Milgram said the scheme solves two problems: the desire of Mexican cartels to repatriate drug proceeds into the Mexican banking system, and that of wealthy Chinese nationals who are restricted by [China’s] capital flight laws from transferring large sums of money held in Chinese bank accounts for use abroad.

Ruggiero noted how the Treasury Department detailed the six-step process Chinese money launderers use to repatriate drug profits to narco-trafficking organizations aka drug cartels. In step one, the Mexican cartel coordinates the delivery of bulk U.S. dollars through couriers to a Chinese money broker within the United States. In step two, the money broker pays the Mexican cartel in pesos in Mexico, taking a 2% commission. Step three involves the broker transferring the U.S. dollars to a processor in the United States who then advertises and sells the U.S. dollars to Chinese nationals in the United States.

Then in step four, the Chinese nationals conduct a mobile China-to-China bank transfer in Chinese currency to bank accounts controlled by the Chinese money-laundering organization. Step five finds the Chinese money-laundering organization selling the Chinese currency to Mexican businesses or Chinese expatriates with business in Mexico to finance the purchase of Chinese goods. Lastly, step six concludes with the Mexican businesses or Chinese expatriates with business in Mexico shipping the goods to Mexico or another destination and selling it for a profit.

Ruggiero's testimony points out how "The State Department has noted that individuals in China can only convert approximately $50,000 worth of Chinese currency into U.S. dollars annually, and the Chinese government has restricted the direct transfer of Chinese currency abroad."

In order to get around these limits, "wealthy Chinese evade these restrictions by buying dollars from money-laundering operations that exchange the U.S. currency for Chinese currency as part of the money-laundering scheme," he said.

The Treasury Department’s February 2022 National Money Laundering Risk Assessment said that Chinese money-laundering organizations are unique because they “offer services at lower fees than traditional money brokers,” Ruggiero said.

The organizations also “provide insurance against losses, in that they will still pay out even if the funds are lost due to theft or interdiction by law enforcement,” he testified.