Bob Passmore, vice president of auto and claims policy for the American Property Casualty Insurance Association (APCIA), told Federal Newswire on Aug. 9 that "legal system abuse" coupled with inflation is causing insurance to get more expensive.

"Across the country, auto insurance premiums have been on the rise for the simple reason that the cost of the things that auto insurance pays for, such as repairing cars and medical care, has been rising," said Passmore. "To put it into perspective, auto insurance claims and expenses spiked to more than $1.12 for every $1 in premium in 2022. It is important to remember that the effects of inflation hit the cost of claims and expenses first, then as insurers adjust their pricing to ‘catch up' to the cost of claims it impacts the premiums consumers pay as their policies renew often a year or more. Legal System Abuse is a major driver of increasing rates for commercial auto, product liability, and other liability, which over the last 5 years all increased much faster than the rate of inflation."

According to a report from Munich Reinsurance (Munich Re), legal system abuse "refers to a variety of tactics the trial bar is using to fund more lawsuits and secure higher verdicts." These tactics include trial lawyers using jurors’ emotions to secure larger verdicts and third-party litigation funding (TPLF), which involves a third-party funder such as a hedge fund providing the capital needed for litigation in exchange for a share of any settlement or award. "There are financial companies that specifically fund lawyers to work on these cases because they’re expecting a large payout. They’re looking to benefit from a nuclear verdict," said Munich Re Head of Casualty Martin Haynes.

The cost of motor vehicle insurance rose 0.9% in June and 19.5% during the year ending in June, according to the latest Consumer Price Index (CPI) summary. In comparison, overall inflation decreased 0.1% in June and stood at +3% for the year ending in June.

In several states, drivers pay even more than the national average for car insurance, such as California, where car insurance costs 12% more than the national average, according to Bankrate. California drivers are spending an average of $2,599 per year for full coverage car insurance. Nevadans are paying even more, at $3,074 per year.

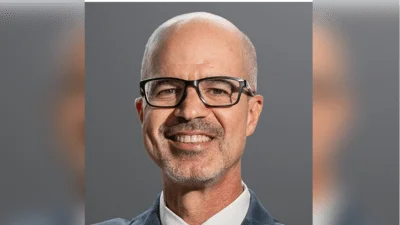

Passmore joined APCIA in 2007, according to LinkedIn. He is also an advisory board member for the Insurance Research Council and a board member of the Insurance Institute for Highway Safety.