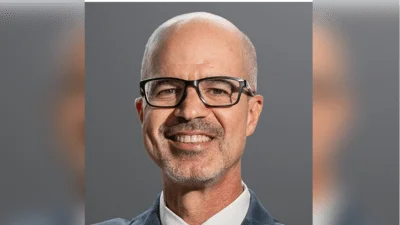

Jeff Brabant, Vice President of Federal Government Relations for the National Federation of Independent Business (NFIB), testified before the U.S. Senate Committee on Finance at a hearing titled, "The 2025 Tax Policy Debate and Tax Avoidance Strategies." Brabant emphasized the importance of making the 20% Small Business Deduction permanent and presented data highlighting the potential adverse effects on small businesses if Congress does not act.

"If Congress fails to act, the 20% Small Business Deduction will expire at the end of 2025 and over 90% of small business owners will see a significant tax increase," Brabant stated. "These small business owners will not be absorbing this increase in a vacuum. They will be absorbing it at a time when their larger C-corporation competitors will not be seeing a tax increase, and at a time when inflation remains hugely problematic for small employers."

Brabant continued, "The decisions Congress makes reflect the values of a Congress. Over the next year, Congress will debate the merits of extending over $4 trillion worth of tax provisions. Members of Congress should ask themselves if they really believe it when they say, 'Small Businesses Are the Backbone of America.' If they truly believe that statement and value small businesses in their communities, then making the 20% small business deduction permanent should be an easy decision."

An analysis conducted by NFIB with Ernst & Young (EY) assessed the impact of permanently extending the 20% Small Business Deduction. The report concluded that such an extension would enable small businesses to create 1.2 million new jobs each year for the first ten years and 2.4 million annually every year thereafter. It would also contribute to a $750 billion GDP increase in the small business sector over ten years and a $150 billion annual increase after that. Without an extension, these benefits to both small businesses and the broader economy would be lost.

Additionally, NFIB released a tax survey examining tax-related challenges for small business owners. The survey revealed that over half of owners believe eliminating the Small Business Deduction would negatively impact their business, leading to increased prices, fewer capital investments, and reduced hiring and job creation on Main Street.

Read Brabant’s full testimony here. Watch his opening statement here.