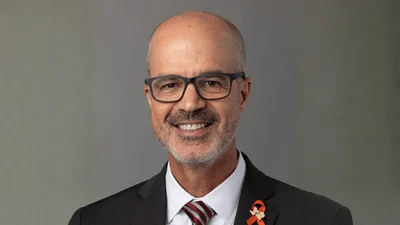

Daniel Bunn President and CEO at Tax Foundation | Twitter Website

The 2025 US tax filing season commenced on January 27th, and it brings to light the ongoing complexity of the nation's tax code. With the expiration of the Trump administration's 2017 tax reforms looming at the end of this year, lawmakers are urged to take this opportunity to simplify what many see as a burdensome system.

Taxes affect all Americans in various ways, from earnings and savings to purchasing and financial planning. Last year alone, over 162 million individual income tax returns were filed. The annual tax filing period often leads to frustration and confusion for many taxpayers. Workers typically receive their W2 forms in January, leading to weeks of concern about potential errors on their returns as they await acceptance by the IRS before the April deadline.

A significant issue is that many Americans do not fully understand how the tax code functions. Recent research indicates that this lack of understanding is widespread among taxpayers.

This article is based on an op-ed initially published in Orange County Register.